Last Updated on May 31, 2023

AM-or-ti-ZA-tion. Try saying that five times fast!

In addition to earning you a zillion Scrabble points, amortization is an important concept for every home buyer to comprehend. After all, it’s the secret to understanding your mortgage loan and paying it down over time. And for a debt as large as a home, that’s a secret you should know!

If you’re taking on a mortgage, there are a few key questions you should be able to answer about amortization schedules. Here are five of the most important things you should know:

What is amortization in regards to home loans?

There are several definitions for amortization in business. When it comes to home loans, amortization is simply the long-term process of paying off a debt with regular fixed payments. An amortization period is the period in which it takes to reduce or pay off your debt. Amortization payments usually remain consistent over time and are determined by an amortization schedule.

What are the two types of amortization?

There are two types of amortization when it comes to home loan repayment.

Straight-Line Amortization (or constant amortization) is a simple method of loan repayment. In this process, the same amount is paid toward the principal each month, but the amount paid toward interest decreases over time with the outstanding balance of the loan. This type of amortization pays down the loan more quickly, and offers more of a tax shield in the beginning, but requires higher payments on the front end.

Mortgage-style Amortization (or constant payment method) is typically the type that home buyers choose. In this style of amortization, the borrower’s monthly installment rate remains the same throughout the loan period. However, the amounts applied to the principal and interest change, so more of the payment goes toward interest in the beginning of the loan. Flat payments are easier to budget for. However, since the bulk of the interest is paid up front, it takes longer to pay down the principal than with straight-line amortization.

Because of its ubiquity, mortgage-style amortization is the type of amortization we’ll refer to throughout the rest of this post.

How do amortization schedules work?

Amortization is the simplest way to pay off a large loan, like a home loan. Financial lenders use amortization schedules to present a loan repayment timeline based on a specific maturity date.

In an amortization schedule, each repayment installment is divided into equal amounts and consists of both principal and interest. At the beginning of the schedule, a greater amount of the payment is applied to interest. With each subsequent payment, a larger percentage of that flat rate is applied to the principal.

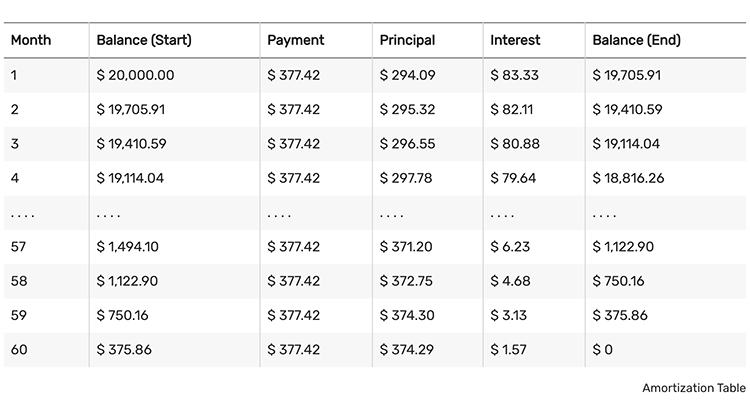

While the amortization equation can look pretty intimidating, today it’s easy to calculate through spreadsheet software or online amortization charts. Here’s an example of an amortization schedule for a $20,000 loan with 5% interest. Note that each month, the total payment stays the same, while the portion going to principal increases and the portion going to interest decreases. In the final month, only $1.57 is paid in interest because the outstanding loan balance at that point is very small.

Is amortization good or bad?

At its core, loan amortization helps you budget for large debts like mortgages or car loans. It’s also a useful tool to demonstrate how borrowing works. By understanding your payment process up front, you can see that sometimes lower monthly installments can result in larger interest payments over time, for example. By reviewing loan amortization tables, you can make a more informed decision about the mortgage lender you choose and the loan option that works best for you.

However, sticking with an amortization can feel like a viscously slow process of paying down your loan. Because a large percentage of your early payments go toward interest and not the principal, it can take years before you see any meaningful decrease in the balance of your loan. Mortgage prepayments and periodic lump sum payments toward the principal can help speed the process along.

Where can you learn more about amortization?

It’s easy to build your own amortization schedule using a loan amortization calculator or creating a spreadsheet from scratch. However, your loan adviser should be able to provide you with one.

At Beverly-Hanks Mortgage Services, we strive to make financing real estate easy and enjoyable. That is why our local financing professionals offer prompt, personal service. You will find we offer a broad menu of financing options, very competitive rates, and customer service that is second to none. Ask us more about how amortization works and how to prepare the right payment schedule for your budget.